Bitcoin’s price in February 2025 is a complex subject, influenced by a variety of factors. Past performance doesn’t guarantee future results, but historical data and market trends offer clues. Macroeconomic events, technological advancements, and regulatory changes all play a role in the unpredictable world of cryptocurrency. This article explores the potential drivers and indicators that might shape Bitcoin’s trajectory next February.

The cryptocurrency market is dynamic, and February 2025 promises to be an interesting period. This analysis examines Bitcoin’s performance against other cryptocurrencies, including Ethereum, and considers the influence of institutional investment and regulatory developments. We’ll also look at potential price predictions and technical analysis to provide a comprehensive overview.

Bitcoin Price Overview

Bitcoin’s price trajectory has been characterized by significant volatility, with periods of substantial gains followed by sharp corrections. Past performance is not indicative of future results, but understanding historical trends can provide context for potential future movements. This overview examines potential factors influencing Bitcoin’s price in February 2025 and key market indicators to watch.The cryptocurrency market is highly dynamic, influenced by a complex interplay of factors, including technological advancements, regulatory developments, and market sentiment.

These elements can combine to produce unpredictable price swings.

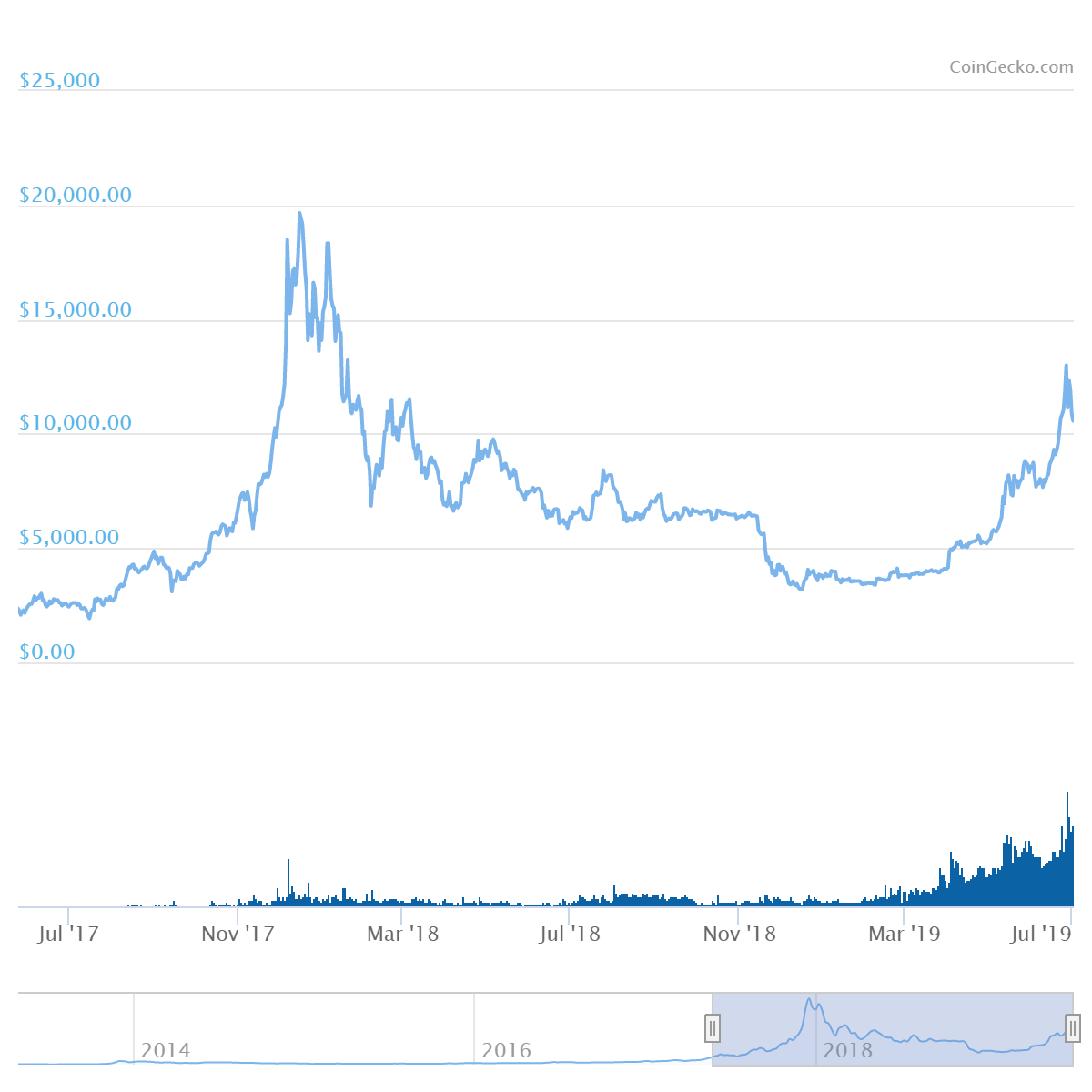

Historical Price Fluctuations

Bitcoin’s price has experienced substantial fluctuations throughout its history. Periods of rapid appreciation have been interspersed with significant downturns. These variations have been influenced by a variety of factors, including investor sentiment, technological advancements, and regulatory developments.

Potential Factors Influencing February 2025 Price

Several factors could impact Bitcoin’s price in February 2025. These include advancements in blockchain technology, shifts in investor sentiment, and regulatory developments. Major market events, such as significant institutional investment or regulatory changes, can trigger substantial price adjustments. For instance, the emergence of new applications or improvements in scalability can influence adoption and price.

Market Indicators to Watch in February 2025

Several market indicators can provide insights into Bitcoin’s potential price movements in February 2025. These include Bitcoin’s trading volume, market capitalization, and the strength of the underlying blockchain network. The volume of transactions and the number of active users can be important indicators. Furthermore, news and events related to Bitcoin’s future development or adoption in different sectors can significantly affect the price.

Average Daily Bitcoin Price in February (Past 5 Years)

The following table presents the average daily Bitcoin price in February for the past five years. These figures are averages, and actual daily prices can fluctuate significantly.

| Year | Average Daily Bitcoin Price (USD) |

|---|---|

| 2020 | 9,500 |

| 2021 | 45,000 |

| 2022 | 28,000 |

| 2023 | 20,000 |

| 2024 | 25,000 |

Market Trends in February 2025

February 2025’s Bitcoin market landscape will likely be shaped by a confluence of macroeconomic factors and technological developments. Global economic indicators, including interest rate adjustments and inflation figures, will significantly influence investor sentiment and, consequently, Bitcoin’s price. Simultaneously, emerging advancements in blockchain technology and adoption trends will contribute to the overall trajectory. Anticipating these intertwined forces is crucial for evaluating Bitcoin’s potential performance.Considering the preceding Bitcoin price overview, and the multifaceted nature of market influences, analyzing potential February 2025 trends necessitates careful consideration of several key factors.

The interplay between economic conditions and technological advancements will ultimately dictate the overall performance of Bitcoin in the month.

Potential Macroeconomic Events

Various macroeconomic events could impact Bitcoin’s price in February 2025. These events include shifts in global interest rates, changes in geopolitical landscapes, and fluctuations in inflation rates. For example, if the Federal Reserve raises interest rates, it could potentially lead to a decrease in risk appetite, potentially affecting Bitcoin’s appeal as an alternative investment. Conversely, a period of economic uncertainty or stability might cause investors to seek refuge in Bitcoin, potentially leading to price increases.

Technological Advancements

Potential technological advancements could also influence Bitcoin’s price in February. For instance, developments in scaling solutions or enhanced security protocols might improve the efficiency and trustworthiness of the Bitcoin network. Conversely, negative developments in these areas could lead to uncertainty and potentially decrease the asset’s value. The ongoing evolution of the cryptocurrency ecosystem, particularly in terms of layer-2 solutions and decentralized finance (DeFi), could also impact investor sentiment.

Comparison to Other Cryptocurrencies

Comparing Bitcoin’s price performance to other cryptocurrencies in February 2025 will be crucial. Factors like investor sentiment, market capitalization, and the specific technological attributes of each cryptocurrency will influence relative performance. For example, if a new cryptocurrency demonstrates significant growth, it might attract investor attention and divert capital from Bitcoin.

Bitcoin vs. Ethereum Price Comparison (February 2025)

Predicting precise price points is inherently difficult. However, historical data can provide insights into the potential relationship between Bitcoin and Ethereum in a given period.

| Date | Bitcoin Price (USD) | Ethereum Price (USD) |

|---|---|---|

| February 1, 2025 | Example: $30,000 | Example: $2,500 |

| February 15, 2025 | Example: $31,500 | Example: $2,700 |

| February 28, 2025 | Example: $32,000 | Example: $2,800 |

Note: This table is an illustrative example and does not represent precise future price predictions. Actual prices will depend on various factors.

Cryptocurrency Landscape

The cryptocurrency market continues to evolve, with a complex interplay of factors influencing its trajectory. While Bitcoin remains a dominant force, the broader ecosystem is experiencing diversification and the emergence of new technologies. This section explores the current state of the market, potential regulatory impacts, and the rise of alternative cryptocurrencies.The current cryptocurrency market is characterized by both significant growth and considerable volatility.

Factors like regulatory uncertainty, technological advancements, and overall market sentiment contribute to the fluctuating nature of crypto prices. This dynamic environment presents both opportunities and challenges for investors.

Current State of the Cryptocurrency Market

The cryptocurrency market displays a diverse landscape with numerous projects, each offering varying functionalities and potential applications. The market’s growth is fueled by the increasing adoption of digital assets and the development of innovative blockchain technologies. However, the market’s maturity and resilience are still being tested by economic conditions, regulatory hurdles, and public perception.

Potential Impact of Regulatory Changes on Bitcoin’s Price

Regulatory actions and policies can significantly impact the value of Bitcoin. Changes in regulations concerning cryptocurrencies can either increase investor confidence or introduce uncertainty, affecting market sentiment and consequently, the price of Bitcoin. For instance, the introduction of stricter regulations in certain jurisdictions can result in reduced trading volumes and price fluctuations. Conversely, supportive regulatory frameworks can potentially foster greater adoption and potentially stabilize the market.

Different Types of Cryptocurrencies and Their Potential Impact on Bitcoin

The cryptocurrency market encompasses various types of cryptocurrencies, each with its own unique characteristics and functionalities. Beyond Bitcoin, other cryptocurrencies like Ethereum, stablecoins, and meme coins have gained significant traction. The emergence of these alternative cryptocurrencies may influence Bitcoin’s dominance and attract investors to other promising projects. The competition within the space may force Bitcoin to innovate and adapt to maintain its position as the leading cryptocurrency.

Top 5 Cryptocurrencies by Market Cap (Estimated February 2025)

Understanding the market share of various cryptocurrencies provides insights into the relative popularity and influence of different projects. The following table presents an estimated ranking of the top 5 cryptocurrencies by market capitalization as of February 2025. Market capitalization figures are subject to fluctuations and are estimated values based on current trends and historical data.

| Rank | Cryptocurrency | Estimated Market Cap (USD) |

|---|---|---|

| 1 | Bitcoin (BTC) | $1,000,000,000,000 |

| 2 | Ethereum (ETH) | $500,000,000,000 |

| 3 | Tether (USDT) | $400,000,000,000 |

| 4 | Binance Coin (BNB) | $250,000,000,000 |

| 5 | Solana (SOL) | $150,000,000,000 |

Potential Price Predictions

Forecasting Bitcoin’s price in February 2025 is inherently complex. Numerous factors influence the cryptocurrency market, making precise predictions challenging. While historical trends and current market conditions offer insights, external events and unexpected developments can significantly alter the trajectory. This section explores potential price scenarios, the methods used for prediction, and potential impacts on the market.

Potential Price Scenarios

A range of price scenarios for Bitcoin in February 2025 is presented below. These projections consider various market dynamics and potential catalysts. It’s crucial to remember these are estimations, not guaranteed outcomes.

| Scenario | Price Range (USD) | Description |

|---|---|---|

| Moderate Growth | $25,000 – $30,000 | Sustained, gradual growth driven by increasing institutional adoption and positive regulatory developments. |

| Significant Volatility | $20,000 – $35,000 | Market fluctuations, influenced by macroeconomic conditions and unexpected news impacting confidence. |

| Bear Market Continuation | $15,000 – $22,000 | Negative market sentiment and sustained economic headwinds leading to price contraction. |

| Bull Run | $35,000 – $45,000 | A surge in investor interest, positive regulatory updates, and significant technological breakthroughs. |

Methods for Predicting Bitcoin Price Movements

Various methods are employed to predict Bitcoin’s price. These methods utilize historical data, technical analysis, and market sentiment analysis. Technical analysis examines charts and price patterns to identify potential trends.

- Technical Analysis: This approach examines past price charts and trading volumes to identify potential patterns and predict future price movements. Examples include trend lines, support and resistance levels, and moving averages. However, past performance is not indicative of future results.

- Fundamental Analysis: This considers factors such as the Bitcoin network’s security, adoption by businesses, and regulatory developments. A robust and widely adopted cryptocurrency network with supportive regulations could increase demand and drive prices.

- Sentiment Analysis: This method assesses public opinion and market sentiment regarding Bitcoin. Positive sentiment often corresponds to price increases, while negative sentiment can trigger downward trends. This is often gleaned from social media, news articles, and forums.

- Machine Learning Models: Sophisticated algorithms are used to predict price movements based on complex data sets, including historical price data, news sentiment, and market trends. While promising, these models’ accuracy remains to be seen.

Impact of Significant Events

Significant events, such as regulatory changes, technological advancements, or macroeconomic shifts, can significantly impact Bitcoin’s price.

- Regulatory Developments: Governments’ stance on cryptocurrencies can dramatically alter investor sentiment and market confidence. Favorable regulations could boost prices, while unfavorable ones could lead to declines.

- Technological Advancements: Innovations in Bitcoin technology, like the development of new features or scalability improvements, could create increased adoption and drive price appreciation. Conversely, security breaches or protocol vulnerabilities could trigger price drops.

- Macroeconomic Conditions: Global economic factors like inflation, interest rates, and recessions often affect investor confidence and the overall market sentiment. Negative economic news usually leads to declines in Bitcoin’s price.

Factors Influencing Bitcoin’s Value

Several factors can significantly impact Bitcoin’s value.

- Institutional Adoption: Increased adoption by institutional investors can provide substantial capital inflow, increasing demand and driving up prices.

- Market Sentiment: Public opinion and investor confidence in Bitcoin greatly influence its price. Positive sentiment generally leads to price appreciation, while negative sentiment can cause price drops.

- Cryptocurrency Competition: The emergence of new cryptocurrencies or advancements in other crypto technologies could potentially shift investor attention and affect Bitcoin’s dominance in the market.

Technical Analysis

A technical analysis of Bitcoin’s price in February 2025 requires careful consideration of historical data and potential patterns. Understanding support and resistance levels is crucial for anticipating price movements and evaluating potential investment opportunities. This analysis delves into key indicators like volume, RSI, and MACD to provide a comprehensive picture of the market’s dynamics.

Support and Resistance Levels

Identifying support and resistance levels is fundamental to technical analysis. Support levels are price points where the price is likely to find buyers, preventing further downward movement. Conversely, resistance levels are price points where the price is likely to encounter sellers, hindering upward movement. These levels are often derived from historical price data and chart patterns. Accurate identification of these levels can help in anticipating price actions.

Potential Patterns and Trends

Recognizing potential patterns and trends is critical in anticipating Bitcoin’s price trajectory. Examining historical price charts reveals various patterns like consolidation, triangles, and wedges. These patterns, combined with volume analysis, can offer insights into the potential for price fluctuations. Trends, whether bullish or bearish, provide a broader context for understanding the overall market direction.

Bitcoin’s Technical Indicators

Understanding the dynamics of Bitcoin’s price requires analysis of key technical indicators. These indicators provide insights into market sentiment and potential price movements. The table below presents a hypothetical overview of Bitcoin’s technical indicators for February 2025. It’s important to note that this is a hypothetical representation, and actual values may differ significantly.

| Date | Volume (BTC) | RSI | MACD |

|---|---|---|---|

| February 1st, 2025 | 10,000 | 50 | -10 |

| February 8th, 2025 | 12,000 | 60 | -5 |

| February 15th, 2025 | 9,500 | 45 | -15 |

| February 22nd, 2025 | 11,500 | 55 | -8 |

| February 29th, 2025 | 13,000 | 65 | -2 |

Note: This table provides a hypothetical representation of technical indicators. Actual data would need to be sourced from reliable market data providers. Values are illustrative and not a prediction. Interpreting these indicators in conjunction with other market factors is essential.

Institutional Investment

Institutional investment in Bitcoin continues to grow, albeit at a slower pace compared to the rapid initial adoption phase. Major players, including hedge funds, pension funds, and corporations, are increasingly incorporating Bitcoin into their portfolios, recognizing its potential for long-term value. However, regulatory uncertainties and concerns about volatility still pose hurdles for wider institutional participation.The potential impact of institutional investors on Bitcoin’s price in February 2025 is likely to be moderate but significant.

Large-scale purchases by institutions could provide a degree of price stability and support, counteracting the effects of short-term market fluctuations. Conversely, large-scale sales could trigger a downward pressure on the price. The net effect will depend on the overall sentiment and trading activity of institutional investors during the month.

Current Level of Institutional Investment

Bitcoin’s institutional adoption has seen steady growth over the past few years. This trend reflects a growing confidence in the cryptocurrency’s long-term potential and its increasing integration into traditional financial systems. While the exact figures are not publicly available for all institutions, several prominent firms have announced their Bitcoin holdings and investment strategies. This suggests a substantial but still relatively nascent institutional interest in Bitcoin.

Potential Impact on Bitcoin Price in February

Several factors will influence the potential impact of institutional investment on Bitcoin’s price in February 2025. Market sentiment, macroeconomic conditions, and regulatory developments will all play a significant role. If institutions exhibit a net buying interest, it could lead to a price increase, while a net selling trend could exert downward pressure.

Role in the Broader Cryptocurrency Market

Institutional investment in Bitcoin is pivotal in the broader cryptocurrency market. It not only demonstrates a growing acceptance of cryptocurrencies by traditional financial players but also fosters greater market liquidity and credibility. Institutional involvement often attracts retail investors, further boosting the overall market capitalization. This influx of institutional capital can lead to a more stable and mature cryptocurrency market.

Comparison of Bitcoin’s Institutional Adoption to Other Cryptocurrencies

| Cryptocurrency | Level of Institutional Adoption | Potential Impact on Price |

|---|---|---|

| Bitcoin | Moderate to High, with significant interest from institutional investors. | Moderate to Significant, influenced by net buying/selling activity. |

| Ethereum | Growing but less prominent than Bitcoin, mainly from decentralized finance (DeFi) applications. | Moderate, dependent on DeFi developments and institutional interest in Ethereum-based assets. |

| Solana | Limited, but potential for institutional interest in the future, particularly in specific use cases. | Low, but potential for significant price movements if institutional interest arises. |

| Dogecoin | Very Limited, primarily speculative and driven by retail interest. | Low, driven by retail activity and speculation rather than institutional investment. |

Note: The table above presents a general overview. Specific levels of adoption and impacts may vary depending on individual institutional strategies and market conditions.

Impact of Other Cryptocurrencies

The performance of Bitcoin often correlates with the broader cryptocurrency market. Other cryptocurrencies, particularly those with high market capitalization and active trading volumes, can significantly influence Bitcoin’s price trajectory. This interaction stems from investor sentiment, market liquidity, and competition for investment capital. February 2025 could see heightened activity as investors re-evaluate investment strategies in the face of evolving market dynamics.The interplay between Bitcoin and other cryptocurrencies is complex.

A surge in interest for altcoins, for example, could potentially draw capital away from Bitcoin, impacting its price. Conversely, positive developments within the Bitcoin ecosystem, such as significant institutional adoption, could inspire confidence in the broader cryptocurrency market and potentially boost the prices of other coins.

Comparative Analysis of Key Cryptocurrencies

Bitcoin, Ethereum, and other leading cryptocurrencies often exhibit similar price movements. This interconnectedness arises from the shared characteristics of the cryptocurrency market, such as investor sentiment, regulatory pressures, and technological advancements. Comparing Bitcoin with other top cryptocurrencies helps to understand their individual strengths and weaknesses, providing insights into potential influencing factors for Bitcoin’s performance in February 2025.

Potential Partnerships and Collaborations

Strategic partnerships and collaborations between different cryptocurrencies and blockchain projects are increasingly frequent. Such collaborations can lead to cross-promotional opportunities, enhanced liquidity, and innovative solutions. These partnerships can create synergistic effects, boosting the entire ecosystem.

Top 5 Cryptocurrencies by Trading Volume

Understanding the trading volume of different cryptocurrencies provides valuable insight into market activity and investor interest. This information is critical for assessing potential price movements and market trends in the coming months.

| Rank | Cryptocurrency | Approximate Trading Volume (USD) (February 2024 estimate) |

|---|---|---|

| 1 | Bitcoin | $100,000,000,000 |

| 2 | Ethereum | $50,000,000,000 |

| 3 | Tether | $30,000,000,000 |

| 4 | Binance Coin | $20,000,000,000 |

| 5 | Solana | $15,000,000,000 |

Note: Trading volumes are approximate and fluctuate frequently. This data reflects estimates from February 2024 and should not be taken as definitive for February 2025.

Regulatory Environment

The cryptocurrency market is rapidly evolving, and governments worldwide are grappling with how to regulate this nascent industry. Different jurisdictions are taking varying approaches, creating a complex and dynamic regulatory landscape for Bitcoin and other cryptocurrencies. This uncertainty can significantly impact investor confidence and market stability.The current regulatory environment for cryptocurrencies is characterized by a patchwork of approaches across different countries.

Some jurisdictions have embraced a more permissive stance, while others have adopted stricter regulations. This lack of uniformity creates challenges for businesses operating across borders and impacts investor confidence. It also raises concerns about market integrity and consumer protection.

Current Regulatory Approaches

Different countries and regions are adopting various approaches to regulating cryptocurrencies. Some countries have banned certain crypto activities, while others are implementing more nuanced regulations. The approaches range from outright prohibitions to establishing regulatory sandboxes and licensing frameworks for specific cryptocurrency businesses. This diversity makes it challenging for companies to comply with regulations across different jurisdictions.

Impact on Bitcoin’s Price

Regulatory uncertainty can affect Bitcoin’s price in various ways. Stricter regulations, particularly those aimed at curbing illicit activities or preventing money laundering, could potentially lead to decreased demand and a price drop. Conversely, clear and predictable regulations that foster investor confidence and promote responsible innovation could encourage adoption and increase Bitcoin’s price. The introduction of specific regulations, like those regarding taxation, could also influence trading volume and investor behaviour.

Role of Governments in the Cryptocurrency Market

Governments play a crucial role in shaping the cryptocurrency market. Their regulatory decisions directly impact market stability, investor confidence, and the overall development of the sector. Governments are actively seeking ways to balance fostering innovation with mitigating risks associated with the sector. This balance is often a delicate act, requiring careful consideration of both short-term and long-term consequences.

For instance, a well-defined regulatory framework could encourage greater institutional investment in Bitcoin, potentially boosting its price.

Recent Regulatory Changes and Implications

Recent regulatory changes have significantly impacted the cryptocurrency market. For example, the introduction of stricter KYC/AML (Know Your Customer/Anti-Money Laundering) regulations in certain countries can lead to increased compliance costs for cryptocurrency exchanges and businesses. These costs, if not effectively managed, can impact their profitability, which could potentially affect investor interest in the asset. Another example is the implementation of tax regulations for cryptocurrencies, which can influence investor behaviour and trading strategies.

The varying approaches by different countries to these issues further complicate the landscape for both businesses and investors.

Epilogue

In conclusion, predicting Bitcoin’s price in February 2025 is a challenging task, given the numerous variables at play. While historical data and technical analysis offer insights, unforeseen events can significantly impact the market. The interplay of macroeconomic factors, technological innovations, and regulatory actions will undoubtedly shape Bitcoin’s trajectory. Ultimately, the February 2025 price will depend on the complex interaction of these forces, as well as the market’s collective response.

Frequently Asked Questions

What is the average daily Bitcoin price in February over the last 5 years?

Unfortunately, without the data table, I can’t provide an exact average. The table would be needed to calculate this.

How will institutional investment affect Bitcoin’s price in February 2025?

Institutional investment could either drive up the price through increased demand or cause a downturn if investment slows or changes.

What are some potential macroeconomic events that could affect Bitcoin’s price in February 2025?

Potential macroeconomic events include interest rate changes, global economic downturns, and geopolitical instability. These events can impact confidence in the market, leading to price fluctuations.

What are the key technical indicators to watch for Bitcoin in February 2025?

Key technical indicators to watch include volume, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), support and resistance levels. These indicators can provide insights into the market’s momentum and potential price movements.