This exploration delves into the intricate relationship between Bitcoin’s price fluctuations and the performance of the S&P 500 index. We’ll examine historical trends, analyze influencing factors, and discuss potential investment implications.

The correlation between these two distinct markets has been a subject of intense debate and analysis. Factors such as investor sentiment, market volatility, and regulatory developments all play a crucial role in shaping the dynamic interplay between them.

Bitcoin Price Correlation with the S&P 500

Bitcoin’s price movements have often been compared to the performance of the S&P 500, a key benchmark of the broader US stock market. Understanding the correlation between these two assets is crucial for investors looking to diversify their portfolios and manage risk. This analysis explores the historical relationship, highlighting periods of alignment and divergence, and assessing the volatility of each asset.The relationship between Bitcoin and the S&P 500 is not straightforward.

While some periods show a positive correlation, others exhibit significant divergence. This complexity stems from Bitcoin’s unique characteristics as a decentralized digital asset, contrasting with the established nature of the S&P 500. The lack of historical precedent for Bitcoin makes predicting its future behavior challenging, especially when considering market forces influencing both assets.

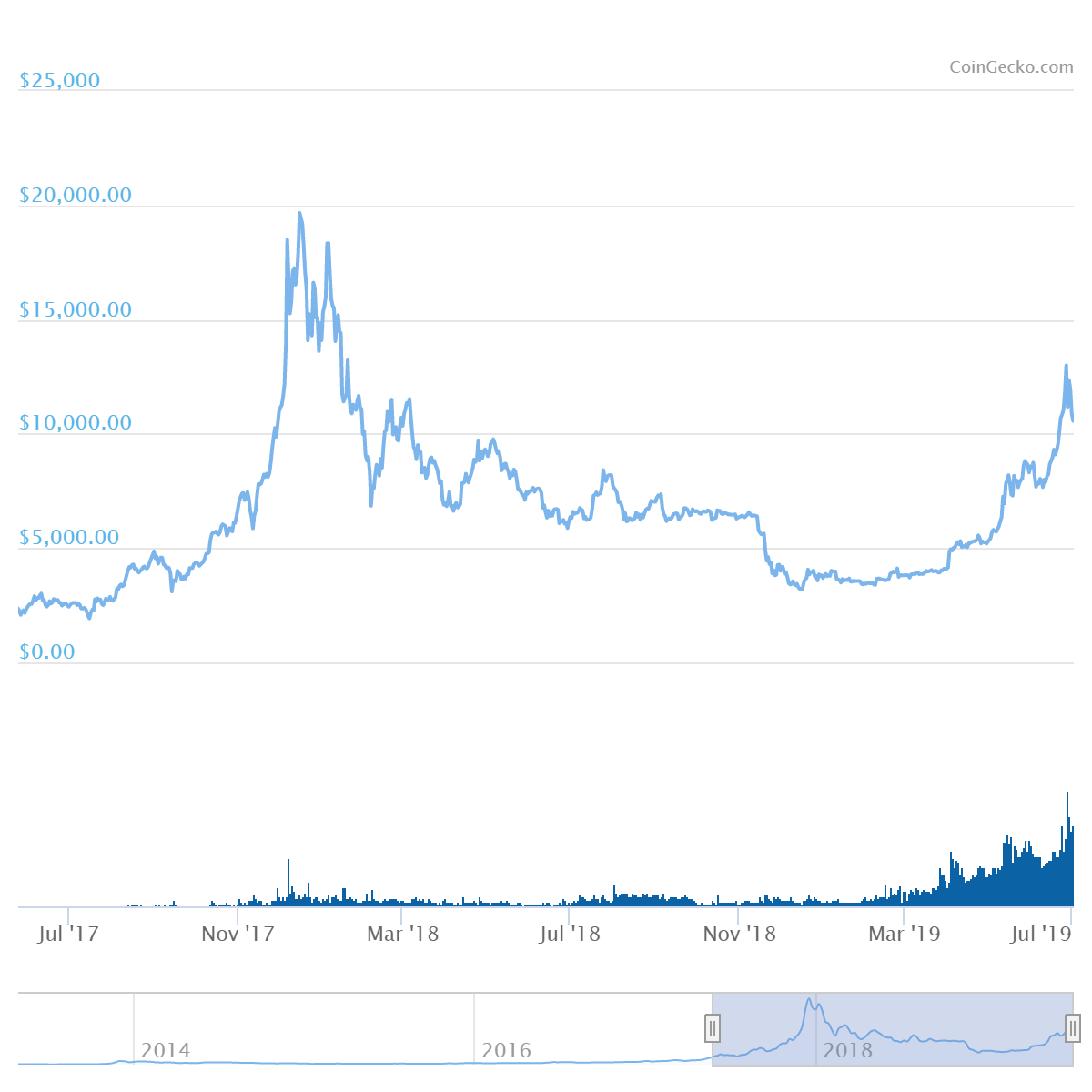

Historical Overview of Price Movements

Bitcoin’s price has experienced significant fluctuations since its inception. Its price movements have been largely independent of traditional financial markets. The S&P 500, representing the performance of large US companies, has shown more predictable, although still volatile, trends. A detailed comparison of their historical performance reveals instances of both strong correlation and significant divergence.

Comparison of Volatility

Bitcoin exhibits significantly higher volatility compared to the S&P 500. This inherent characteristic of cryptocurrencies reflects the speculative nature of the market and the relatively limited trading history of Bitcoin. The S&P 500, on the other hand, represents a more established market with a longer history, resulting in lower volatility compared to Bitcoin.

Periods of Strong Correlation and Divergence

Several periods have shown correlation between Bitcoin’s price and the S&P 500. For example, periods of heightened risk aversion in the traditional markets, such as during economic downturns or financial crises, often saw both Bitcoin and the S&P 500 decline. Conversely, periods of market optimism have sometimes coincided with price increases in both assets. However, it’s crucial to acknowledge periods of divergence.

Bitcoin’s price movements can be influenced by factors unrelated to traditional market sentiment, including regulatory changes, technological advancements, or news events. This makes the relationship between the two assets complex and unpredictable.

Performance Comparison Over Time

This table displays a simplified comparison of Bitcoin’s price to the S&P 500’s performance over various timeframes. Note that this is a simplified representation and does not capture all nuances of the relationship.

| Timeframe | Bitcoin Performance | S&P 500 Performance |

|---|---|---|

| Daily (2023) | Moderate Volatility | Moderate Volatility |

| Weekly (2023) | High Volatility | Lower Volatility |

| Monthly (2023) | Significant Fluctuations | Relative Stability |

Note: This table is a simplified illustration. Actual performance data would require a more comprehensive analysis including specific dates and detailed performance metrics.

Factors Influencing the Relationship

The correlation between Bitcoin’s price and the S&P 500’s performance is a complex interplay of various economic and market forces. While a direct, predictable relationship hasn’t consistently emerged, understanding the factors driving these fluctuations is crucial for investors. The interplay of investor sentiment, regulatory changes, and broader economic trends all contribute to the dynamic nature of this correlation.The relationship between Bitcoin and the S&P 500 is not a simple cause-and-effect model.

Instead, it’s a multifaceted interaction where multiple factors influence price movements in both markets. The fluctuating nature of the correlation suggests that a precise, predictable link is elusive, and a deeper understanding of these factors is necessary for informed investment decisions.

Economic and Market Factors

Various economic and market conditions significantly impact both Bitcoin and the S&P 500. Interest rate changes, inflation, and global economic growth affect investor confidence in both traditional and digital assets. For example, periods of economic uncertainty often see investors seeking safe-haven assets like the S&P 500, potentially leading to a negative correlation with Bitcoin, as risk appetite shifts.

Conversely, periods of optimism can boost both assets. Market volatility and overall market sentiment also play a critical role in shaping the correlation.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation are key drivers of price fluctuations in both Bitcoin and the S&P 500. FOMO (Fear Of Missing Out) and exuberance can create speculative bubbles in either market, while fear and uncertainty can trigger selloffs. For instance, the rapid increase in Bitcoin’s price in 2021 was largely fueled by speculative trading, which was also a factor in the subsequent decline.

Similarly, market sentiment surrounding the S&P 500 is influenced by numerous factors, including news events, economic forecasts, and investor psychology.

Regulatory Developments

Regulatory developments play a critical role in shaping the cryptocurrency market, including its relationship with the S&P 500. Government regulations, both positive and negative, can significantly affect investor confidence and trading volume in Bitcoin and other cryptocurrencies. For example, favorable regulatory frameworks can foster adoption and attract mainstream investment, leading to a positive correlation with traditional assets. Conversely, regulatory uncertainty or restrictions can create volatility and discourage investment, potentially resulting in a negative correlation.

Potential Catalysts for Correlation

Several factors can influence the direction of the correlation between Bitcoin and the S&P 500. Positive catalysts include periods of strong economic growth, increased institutional adoption of Bitcoin, and a reduction in regulatory uncertainty. Negative catalysts include economic downturns, increased regulatory scrutiny, and widespread market skepticism toward Bitcoin. The effect of these catalysts is not always immediate or linear.

Major Economic Events Influencing Correlation

| Event | Impact on Correlation | Description |

|---|---|---|

| 2020 COVID-19 Pandemic | Mixed | The pandemic caused significant market volatility. Investors sought safe-haven assets, potentially leading to a negative correlation, but Bitcoin also saw strong adoption, which influenced its price. |

| 2022 Crypto Winter | Negative | A sharp decline in cryptocurrency prices, partially due to regulatory concerns and market speculation, often resulted in a negative correlation with the S&P 500. |

| 2023 Interest Rate Hikes | Negative | Global interest rate increases and rising inflation can cause uncertainty and potentially decrease investor interest in both Bitcoin and the S&P 500. |

Cryptocurrency Market Dynamics

The cryptocurrency market, a relatively recent phenomenon, has rapidly evolved from a niche interest to a significant global financial force. Its volatile nature and decentralized structure present both opportunities and challenges for investors and regulators alike. Understanding the nuances of this market is crucial for evaluating its potential impact on traditional financial systems and the broader economy.The history of cryptocurrencies began with Bitcoin, launched in 2009.

This initial cryptocurrency was conceived as a decentralized digital currency, independent of central banks and financial institutions. Since then, the market has exploded, spawning numerous other cryptocurrencies, each with unique features and purposes. The current state of the market is characterized by significant price fluctuations, ongoing regulatory debates, and a growing push for institutional adoption.

Unique Characteristics of Bitcoin and Other Cryptocurrencies

Bitcoin, and other cryptocurrencies, are fundamentally different from traditional assets like stocks and bonds. Their decentralized nature, underpinned by blockchain technology, enables peer-to-peer transactions without intermediaries. This characteristic facilitates faster and potentially cheaper transactions compared to traditional methods. Cryptocurrencies also often utilize cryptography to secure transactions and maintain a public ledger of all transactions. This transparency, while promoting trust for some, also exposes them to potential vulnerabilities.

Types of Cryptocurrencies and Their Purposes

The cryptocurrency landscape is diverse. Beyond Bitcoin, various cryptocurrencies exist, each serving different purposes. Some, like Ethereum, are focused on facilitating decentralized applications (dApps), offering smart contract functionality. Others, like stablecoins, aim to mitigate the volatility inherent in cryptocurrencies by pegging their value to traditional assets like the US dollar. The different functionalities and objectives of various cryptocurrencies reflect the broad spectrum of use cases envisioned for this technology.

Key Differences Between Traditional Investments and Cryptocurrencies

Traditional investments like stocks and bonds are typically regulated and overseen by government agencies. Conversely, cryptocurrencies operate in a largely decentralized environment, with varying degrees of regulatory oversight depending on the jurisdiction. This difference in regulatory frameworks impacts the level of investor protection and market stability. Furthermore, the volatile nature of cryptocurrency prices contrasts sharply with the more stable, predictable returns often associated with traditional investments.

Furthermore, traditional investments generally benefit from established trading infrastructure and regulatory frameworks, features absent in the crypto market’s early stages.

Top 5 Cryptocurrencies by Market Capitalization (Approximate, as of [Date])

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Binance Coin (BNB)

- USD Coin (USDC)

This list represents a snapshot of the market at a particular time. Market capitalization, reflecting the total value of a cryptocurrency, can fluctuate significantly based on market conditions and investor sentiment. This dynamic nature of the cryptocurrency market needs to be considered when analyzing investment strategies.

Growth Rates Compared to the S&P 500

The growth rates of Bitcoin and other leading cryptocurrencies have often diverged significantly from the S&P 500’s performance. Some periods have shown strong correlations, while others have exhibited substantial divergence, highlighting the unique market dynamics of cryptocurrencies. Past performance is not indicative of future results, and factors beyond traditional market forces often influence cryptocurrency price movements. The unpredictable and volatile nature of the cryptocurrency market can make comparing growth rates with the S&P 500 problematic, as they often lack direct correlation.

Influence of Institutional Adoption on the Cryptocurrency Market

Institutional adoption of cryptocurrencies has been a growing trend, with major financial institutions and corporations exploring and implementing cryptocurrency-related strategies. This growing interest from established entities can potentially contribute to increased market stability and mainstream acceptance. However, the integration of institutional investors also introduces new challenges, such as regulatory compliance and managing risk. A significant factor influencing the future of cryptocurrencies is the extent of institutional adoption, which can either drive market growth or lead to significant volatility.

Investment Strategies and Implications

The correlation between Bitcoin’s price and the S&P 500 presents unique investment opportunities and challenges. Understanding these dynamics is crucial for crafting effective investment strategies that potentially leverage this relationship while mitigating inherent risks. A well-considered approach to portfolio diversification and risk management is paramount.

Investment Strategies Considering Correlation

Strategies that account for the correlation between Bitcoin and the S&P 500 often involve diversification. Investors can consider allocating a portion of their portfolio to Bitcoin, particularly if they believe the cryptocurrency market will outperform the traditional stock market over the long term. This strategy can provide diversification benefits, especially if the two markets don’t move in tandem.

Diversification Benefits of Including Bitcoin

Including Bitcoin in a portfolio can potentially enhance diversification. Bitcoin, as a non-correlated asset, can act as a hedge against traditional market downturns. Historically, periods of market volatility have seen Bitcoin’s price fluctuate differently than the S&P 500. This divergence in performance can offer portfolio protection during times of uncertainty. However, it’s important to note that this diversification effect is not guaranteed and depends on the specific market conditions.

Risks Associated with Bitcoin and Cryptocurrencies

Investing in Bitcoin and other cryptocurrencies comes with inherent risks. Volatility is a significant concern, with prices often experiencing sharp fluctuations. The regulatory landscape for cryptocurrencies is still evolving, and this uncertainty can create additional risks for investors. Security risks, such as hacking and theft, are also present, demanding careful consideration of wallet security measures. The lack of established historical performance data compared to traditional assets like stocks also contributes to the overall risk profile.

Importance of Risk Management in Portfolio Construction

Risk management is critical when incorporating Bitcoin into an investment portfolio. Diversification, as previously mentioned, is a key component. Setting clear risk tolerance levels and investment goals is essential for investors. Understanding the potential downsides and developing strategies to mitigate those risks is crucial. Investors should not allocate a substantial portion of their portfolio to Bitcoin if they are not prepared to accept the associated volatility.

Potential Risks and Rewards of Investing in Bitcoin

| Factor | Potential Risk | Potential Reward |

|---|---|---|

| Volatility | Significant price swings can lead to substantial losses. | Potentially high returns during periods of market outperformance. |

| Regulatory Uncertainty | Changes in regulations can impact the value and accessibility of Bitcoin. | Favorable regulatory developments could boost investor confidence and prices. |

| Security Risks | Hacking and theft are potential threats to investor funds. | – |

| Lack of Historical Data | Limited historical data makes it challenging to predict future performance. | – |

| Liquidity Concerns | Difficulty in quickly buying or selling Bitcoin in certain market conditions. | – |

Future Outlook and Predictions

The correlation between Bitcoin’s price and the S&P 500’s performance continues to be a subject of intense debate and analysis. Predicting the future trajectory of this relationship is challenging, given the volatile nature of both the cryptocurrency and traditional financial markets. However, examining expert opinions, technological advancements, and potential scenarios can provide valuable insights into possible future outcomes.While a definitive prediction remains elusive, a comprehensive understanding of the factors influencing this relationship is essential for investors navigating the complexities of both markets.

This analysis explores potential future trends and considers the impact of evolving technologies on the correlation between Bitcoin and the S&P 500.

Potential Future Trajectory of the Correlation

The future correlation between Bitcoin and the S&P 500 is likely to be influenced by several factors, including broader market sentiment, regulatory developments, and technological advancements. There is no single consensus view, with varying opinions across experts. Some predict a strengthening correlation as Bitcoin matures and gains wider acceptance, while others foresee a more decoupled relationship as the cryptocurrency market evolves independently.

Expert Opinions on Long-Term Outlook

Various experts offer contrasting perspectives on the long-term outlook for Bitcoin and the broader cryptocurrency market. Some analysts suggest that Bitcoin’s integration into mainstream finance will eventually lead to a stronger correlation with traditional asset classes like the S&P 500, mirroring the convergence of other innovative technologies into established markets. Others contend that the inherent volatility and decentralized nature of cryptocurrencies will maintain a more independent path, potentially leading to a weaker or even negative correlation with traditional market indices.

A key factor in these diverging views is the evolving regulatory landscape and investor confidence in the long-term viability of Bitcoin.

Impact of Technological Advancements

Technological advancements, such as the development of new blockchain technologies and the integration of cryptocurrencies into existing financial systems, can significantly impact the correlation between Bitcoin and the S&P 500. For example, advancements in blockchain technology that improve scalability and transaction speeds could lead to greater institutional adoption and a stronger correlation. Conversely, the emergence of alternative cryptocurrencies or competing technologies could potentially diminish Bitcoin’s influence and impact on the overall correlation.

Potential Scenarios for the Future Relationship

Several scenarios can be envisioned for the future relationship between Bitcoin and the S&P 500. One scenario involves a gradual increase in correlation as Bitcoin’s adoption within institutional portfolios and mainstream financial instruments grows. A second scenario depicts a more independent and volatile relationship, with Bitcoin exhibiting its own unique market cycles and less synchronized movement with the S&P 500.

A third scenario suggests a negative correlation, where Bitcoin’s price fluctuations are inversely proportional to the S&P 500’s performance, reflecting a divergence of investment interests. Ultimately, the specific scenario that unfolds will depend on numerous factors and market dynamics.

Ending Remarks

In conclusion, the Bitcoin price versus S&P 500 relationship is complex and multifaceted. Understanding the historical trends, influencing factors, and potential future scenarios is essential for investors seeking to navigate this dynamic landscape. The correlation between these assets is not static and warrants ongoing scrutiny and analysis.

FAQ Overview

What is the typical correlation between Bitcoin and the S&P 500 over the past 5 years?

Correlation coefficients have varied over this period, sometimes showing a positive relationship, other times negative, and sometimes near zero. The relationship isn’t consistent and depends on various market conditions.

How does investor sentiment impact the price movements of both assets?

Investor confidence and fear in both the cryptocurrency and traditional markets greatly influence the price action of each asset. Positive sentiment often boosts prices in both areas, while negative sentiment can depress them.

What are the key differences between investing in traditional stocks and cryptocurrencies?

Traditional stocks are usually backed by established companies and their assets. Cryptocurrencies, conversely, are decentralized digital assets with a different regulatory environment and inherent risks.

What are the potential risks associated with investing in Bitcoin?

Bitcoin investments come with significant price volatility, market manipulation risk, regulatory uncertainty, and the potential for hacking or security breaches.