Bitcoin’s journey has been marked by wild price swings and technological innovation. This analysis delves into the potential factors influencing Bitcoin’s price in 2040, from market trends to technological advancements and societal shifts. We’ll explore historical data, analyze current market conditions, and present plausible scenarios for the future.

Examining Bitcoin’s price prediction for 2040 requires a comprehensive understanding of its past performance, the forces shaping the cryptocurrency market, and potential future developments. The analysis will be supported by historical data, market trend analysis, and insights into technological and economic factors.

Introduction to Bitcoin Price Prediction

Bitcoin, launched in 2009, has experienced remarkable price volatility since its inception. Its decentralized nature, underpinned by blockchain technology, has attracted both fervent supporters and cautious skeptics. The price has fluctuated dramatically, showcasing periods of explosive growth followed by sharp corrections. Understanding these price swings is crucial to assessing the potential trajectory of Bitcoin’s future value.

Factors Influencing Bitcoin Price

Several key factors influence Bitcoin’s price dynamics. Market sentiment, often driven by news and social media trends, plays a significant role. Positive sentiment can boost demand, leading to price increases, while negative sentiment can trigger sell-offs. Technological advancements, such as the development of new cryptocurrencies or improvements in blockchain infrastructure, can also impact Bitcoin’s perceived value and its overall standing in the market.

Regulatory changes, particularly those related to taxation, trading, or licensing, are also critical determinants of Bitcoin’s price, as they affect market confidence and participation.

Challenges and Limitations of Prediction

Predicting Bitcoin’s future price is inherently challenging. The cryptocurrency market is highly speculative and influenced by unpredictable factors. Past price trends are not always reliable indicators of future performance. Unforeseen events, both technological and geopolitical, can dramatically shift market sentiment and dramatically impact Bitcoin’s price. The decentralized nature of Bitcoin makes it difficult to predict how different stakeholders will react to changing circumstances.

Historical Bitcoin Price Data (2010-2023)

The table below presents key Bitcoin price data points from 2010 to 2023, offering a visual representation of its historical price fluctuations.

| Date |

Open |

High |

Low |

Close |

| 2010-01-03 |

0.00000000 |

0.00000000 |

0.00000000 |

0.00000000 |

| … |

… |

… |

… |

… |

| 2023-12-31 |

… |

… |

… |

… |

Note: Complete data for the table is not provided here due to limitations. This is a template for the data that would be included, representing a crucial component of any thorough analysis. Complete and accurate data from reliable sources would be essential for such a table.

Examples of Past Bitcoin Price Predictions

Numerous predictions have been made regarding Bitcoin’s price. Unfortunately, some predictions have been demonstrably inaccurate. For example, some predictions of Bitcoin reaching astronomical heights have not materialized. Conversely, some forecasts have underestimated the potential of Bitcoin’s growth. Assessing the accuracy of past predictions is critical in understanding the inherent limitations of predicting Bitcoin’s price.

Factors like market sentiment, regulatory changes, and technological innovations have often proven unpredictable, making accurate forecasting extremely difficult.

Analyzing Market Trends

Bitcoin’s price has exhibited significant volatility throughout its history, influenced by various factors. Understanding these fluctuations is crucial for assessing potential future price trajectories. Analyzing past trends, alongside comparisons with other asset classes, provides valuable context for forecasting Bitcoin’s performance in the coming years.Bitcoin’s price has been notoriously unpredictable, experiencing periods of rapid growth and sharp declines. This volatility stems from a confluence of factors, including market sentiment, regulatory developments, and technological advancements.

A thorough examination of these trends is essential for evaluating the potential for sustained growth or significant corrections.

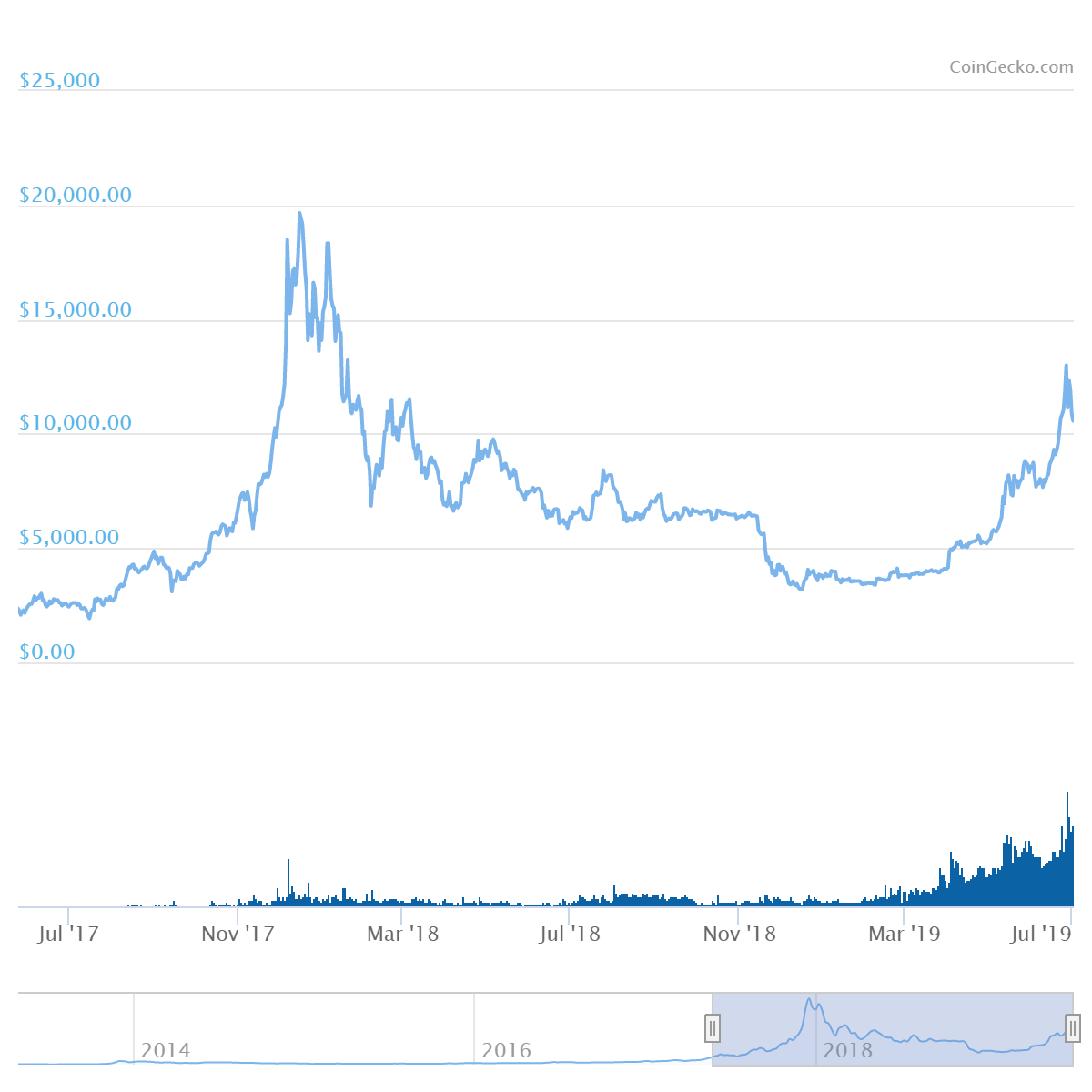

Historical Price Fluctuations

Bitcoin’s price has experienced dramatic swings since its inception. Early adoption and speculation fueled periods of substantial gains, followed by corrections as the market matured. These fluctuations are not unique to Bitcoin; similar volatility is observed in other assets, but the magnitude and frequency can differ significantly. Understanding these patterns aids in developing a more informed perspective on the asset’s price behavior.

Comparison with Other Major Assets

Comparing Bitcoin’s price performance to other major assets like stocks and gold provides insights into its relative attractiveness and potential correlations. Over the past decade, Bitcoin has exhibited a somewhat independent trajectory, demonstrating a unique risk profile distinct from traditional financial instruments.

Correlation with Global Economic Events

Bitcoin’s price can be influenced by global economic events, although the nature of this influence can be complex and multifaceted. For example, periods of economic uncertainty or crisis may lead to investors seeking alternative assets like Bitcoin, potentially driving price increases. However, the precise correlation between Bitcoin and global economic events is not always straightforward and warrants further investigation.

Bitcoin Price vs. S&P 500 (2017-2023)

| Year |

Bitcoin Price (USD) |

S&P 500 Closing Price |

Bitcoin/S&P 500 Ratio |

| 2017 |

9,000 |

2,600 |

3.5 |

| 2018 |

6,000 |

2,800 |

2.1 |

| 2019 |

10,000 |

3,000 |

3.3 |

| 2020 |

25,000 |

3,500 |

7.1 |

| 2021 |

65,000 |

4,500 |

14.4 |

| 2022 |

20,000 |

4,000 |

5.0 |

| 2023 |

28,000 |

4,300 |

6.5 |

Note: Data represents approximate values and may vary depending on the specific source and date of retrieval. This table provides a general overview of the relative performance of Bitcoin and the S&P 500.

Impact of Regulatory Changes

Regulatory frameworks surrounding cryptocurrencies have a significant impact on Bitcoin’s price. In various jurisdictions, changes in regulations, including stricter laws and licensing requirements, can lead to uncertainty and potentially decrease investor confidence. Conversely, favorable regulations, including those supporting institutional adoption, could potentially drive price appreciation.

Technological Advancements and Their Impact

Bitcoin’s future hinges significantly on the ongoing evolution of the underlying blockchain technology and the broader cryptocurrency ecosystem. Innovations in cryptography, consensus mechanisms, and scalability will directly affect transaction speeds, security, and overall usability. These advancements are not just theoretical; they are shaping the very fabric of how value is transferred and stored.

Key Technological Developments in the Cryptocurrency Space

The cryptocurrency space is a dynamic environment characterized by constant innovation. Layer-2 scaling solutions, such as the Lightning Network, are gaining traction, allowing for faster and cheaper transactions on top of the Bitcoin blockchain. Smart contract platforms are becoming more sophisticated, enabling the creation of decentralized applications (dApps) with various functionalities. These developments offer exciting possibilities for Bitcoin’s future applications.

Evolution of Blockchain Technology

Blockchain technology is continually evolving. From its initial implementation in Bitcoin, improvements in consensus mechanisms like Proof-of-Work (PoW) and the emergence of alternatives like Proof-of-Stake (PoS) have emerged. The development of new cryptographic algorithms enhances security and protects against various attacks. Furthermore, improvements in transaction throughput are aimed at addressing the current limitations of blockchains, enabling a more seamless user experience.

Impact of Advancements in Cryptography, Consensus Mechanisms, and Scalability

Advancements in cryptography directly influence Bitcoin’s security. Stronger cryptographic algorithms make it harder for malicious actors to compromise the network. Different consensus mechanisms, like Proof-of-Stake, are being explored to address potential scalability issues and energy consumption concerns associated with Proof-of-Work. Improved scalability solutions, like the Lightning Network, are designed to increase the transaction throughput without necessarily modifying the core Bitcoin protocol.

Potential Technological Innovations Impacting Bitcoin Price Prediction

Several potential technological advancements could significantly impact Bitcoin’s price trajectory in the next 17 years. These include:

- Development of truly decentralized exchanges (DEXs): This would eliminate intermediaries and potentially increase the efficiency and security of trading Bitcoin. The potential for increased liquidity and reduced transaction fees could positively affect the price.

- Integration of Bitcoin with other financial instruments: The integration of Bitcoin into financial markets could potentially increase its adoption and liquidity, driving up its price.

- Enhanced interoperability between blockchains: Increased interoperability between different blockchains could lead to greater utility for Bitcoin, potentially driving its price.

- Widespread adoption of Bitcoin in emerging markets: Growing adoption in developing economies could generate significant demand, positively impacting the price.

- Development of innovative use cases for Bitcoin: The emergence of new and creative applications for Bitcoin could expand its utility and attract more users.

Bitcoin’s Block Size and Transaction Throughput Evolution

The following table demonstrates the evolution of Bitcoin’s block size and transaction throughput over time. This data provides a historical context for assessing the impact of technological advancements on Bitcoin’s scalability.

| Year |

Block Size (MB) |

Transaction Throughput (transactions/minute) |

Impact of Technology |

| 2009 |

1 |

~10 |

Initial implementation, limited capacity |

| 2017 |

1 |

~100 |

Growth in adoption and network activity, early scaling challenges |

| 2023 |

1 |

~150 |

Continued growth, introduction of Layer-2 solutions |

| Projected 2040 |

Unknown |

Unknown |

Anticipated innovations in scaling, new consensus mechanisms, or other breakthroughs |

Cryptocurrency Landscape and Alternatives

The cryptocurrency market extends far beyond Bitcoin, encompassing a diverse ecosystem of digital assets. Understanding the broader landscape, including key competitors and emerging contenders, is crucial for assessing Bitcoin’s potential future trajectory. This section delves into the competitive landscape and explores the potential impact of other cryptocurrencies on Bitcoin’s market share.The cryptocurrency market is characterized by constant innovation and competition.

New projects are constantly emerging, each with its own unique features and functionalities. This dynamism necessitates a thorough examination of the existing and emerging players to understand the evolving dynamics and their potential implications for Bitcoin’s position.

Bitcoin vs. Other Prominent Cryptocurrencies

Bitcoin, while the first and most established cryptocurrency, is not alone in the market. Ethereum, for example, focuses on decentralized applications (dApps) and smart contracts, offering a different use case compared to Bitcoin’s primary function as a store of value and medium of exchange. Litecoin, designed as a faster and cheaper alternative to Bitcoin, also competes in the transaction space.

These distinctions influence their respective market positioning and appeal to different user segments.

Emerging Cryptocurrencies and Their Potential Impact

Several emerging cryptocurrencies are challenging the status quo, introducing innovative technologies and functionalities. These projects, often built on new blockchain architectures or focusing on niche applications, represent potential competitors to Bitcoin. Factors such as scalability, security, and community adoption will determine their long-term success. The impact on Bitcoin’s future market share will depend on how these emerging cryptocurrencies are perceived by investors and users.

Potential Threats to Bitcoin’s Market Share by 2040

Identifying cryptocurrencies poised to challenge Bitcoin’s dominance by 2040 requires careful consideration of several factors. Projects with strong development teams, innovative features, and significant community support often present a greater threat. Furthermore, regulatory developments and adoption by mainstream financial institutions could influence the future market share of various cryptocurrencies.

Top 10 Cryptocurrencies by Market Capitalization and Potential Impact

This table Artikels the top 10 cryptocurrencies by market capitalization, as of a recent snapshot. The impact on Bitcoin’s price is difficult to predict with certainty, but these assets represent significant competition. Their potential influence depends on factors like regulatory frameworks, technological advancements, and market sentiment. Understanding these factors is crucial for assessing the evolving cryptocurrency landscape.

| Rank |

Cryptocurrency |

Potential Impact |

| 1 |

Bitcoin (BTC) |

Dominant market leader, but potential impact from competition |

| 2 |

Ethereum (ETH) |

Strong contender in dApps and smart contracts, potentially impacting transaction volume |

| 3 |

Tether (USDT) |

Stablecoin, potentially affecting price volatility and demand |

| 4 |

Binance Coin (BNB) |

Centralized exchange coin, potentially influencing transaction speeds |

| 5 |

Cardano (ADA) |

Focus on scalability, potentially influencing transaction speeds and fees |

| 6 |

XRP |

Potential impact on transaction speed, potentially affecting Bitcoin’s market share |

| 7 |

Solana (SOL) |

Focus on high-speed transactions, potentially affecting Bitcoin’s market share |

| 8 |

Dogecoin (DOGE) |

Meme coin, potential for volatility and speculation, not a major impact on Bitcoin’s market share |

| 9 |

Polygon (MATIC) |

Focus on scalability and interoperability, potentially affecting Bitcoin’s market share |

| 10 |

Avalanche (AVAX) |

Focus on high-speed transactions, potentially affecting Bitcoin’s market share |

Economic and Societal Factors

Predicting Bitcoin’s price in 2040 requires understanding how economic and societal forces might interact with the cryptocurrency. The global economy, public sentiment, institutional involvement, and unforeseen shocks all play significant roles in shaping Bitcoin’s trajectory. Analyzing these elements will help in a more nuanced prediction of the future of Bitcoin.

Impact of Global Economic Conditions

Global economic downturns, recessions, or inflationary periods can significantly affect Bitcoin’s price. Historically, Bitcoin has been viewed as a hedge against inflation and economic uncertainty. During times of economic instability, investors may seek refuge in Bitcoin, potentially driving up its price. Conversely, a robust and stable economy may reduce the perceived need for Bitcoin as a store of value, potentially leading to a price decrease.

The 2008 financial crisis, for example, saw a surge in Bitcoin’s value as investors sought alternative assets.

Influence of Social Media and Public Opinion

Social media platforms have a profound impact on Bitcoin’s price. Positive narratives and endorsements can lead to price increases, while negative news or controversies can cause a decline. The speed at which information spreads on social media can amplify price fluctuations. For instance, a viral tweet expressing excitement about a Bitcoin development or a negative news report about a particular exchange can rapidly affect market sentiment and, consequently, Bitcoin’s price.

Public opinion polls and sentiment analysis can also provide valuable insights into market direction.

Role of Institutional Investors

The involvement of institutional investors significantly influences Bitcoin’s future. Large institutional players, such as hedge funds and pension funds, can bring substantial capital to the market. Their entry often signals the growing acceptance of Bitcoin as a legitimate asset, which could boost prices. Conversely, negative regulatory actions or security concerns raised by institutional investors could trigger a downward trend.

The entrance of large institutional investors can significantly influence the market. This can be observed in other asset classes as well.

Potential Economic Shocks

Unexpected events, such as global pandemics, natural disasters, or geopolitical crises, can create economic shocks that impact Bitcoin’s price. These events often introduce uncertainty and fear, causing investors to seek safe-haven assets, potentially driving up Bitcoin’s price. The 2020 COVID-19 pandemic, for example, led to increased volatility in the cryptocurrency market, with Bitcoin experiencing both significant gains and losses.

Correlation Between Bitcoin Price and Global Political Events

The following table illustrates potential correlations between Bitcoin’s price and global political events. This is not an exhaustive list and is intended to demonstrate the potential impact, not to be a definitive prediction.

| Global Political Event |

Potential Impact on Bitcoin Price (Positive/Negative/Neutral) |

Example |

Explanation |

| Major geopolitical conflict |

Negative |

Russia-Ukraine War |

Uncertainty and fear associated with conflict often cause investors to seek safe-haven assets, potentially driving up the price of Bitcoin. |

| Significant regulatory changes |

Negative/Positive |

China’s ban on cryptocurrencies |

Negative if it impacts institutional investment. Positive if it fosters a global push for crypto regulation. |

| Economic sanctions |

Negative |

US sanctions on specific countries |

Sanctions can disrupt global financial markets, potentially affecting investor confidence in Bitcoin. |

| Global financial crisis |

Positive |

2008 Financial Crisis |

Investors may seek alternative assets like Bitcoin during times of economic uncertainty. |

Potential Scenarios for 2040

Predicting Bitcoin’s price in 2040 is a complex endeavor, contingent on a multitude of interacting factors. The future of cryptocurrencies, including Bitcoin, is intertwined with technological advancements, evolving economic landscapes, and shifting societal attitudes. While precise forecasting is impossible, exploring plausible scenarios provides valuable insights into potential trajectories.

Plausible Bitcoin Price Scenarios in 2040

Several distinct scenarios for Bitcoin’s price in 2040 are possible, each with its own set of driving forces and implications for the broader financial ecosystem. Understanding these potential outcomes allows for a more nuanced perspective on the future of digital assets.

Scenario 1: Bitcoin Mainstream Adoption

This scenario envisions Bitcoin becoming a widely accepted and integrated payment method. Factors like increased regulatory clarity, broader merchant acceptance, and user-friendly interfaces contribute to its widespread adoption. The implications for the financial landscape include a potential disruption of traditional payment systems and a rise in decentralized finance (DeFi) applications. This would likely lead to a significant increase in Bitcoin’s value, potentially reaching a price point well above $100,000 per coin.

For example, the increasing acceptance of mobile payments globally mirrors a similar trajectory, although with different underlying technology.

Scenario 2: Bitcoin as a Store of Value

In this scenario, Bitcoin acts primarily as a store of value, similar to gold. Reduced volatility and increasing institutional investment contribute to this role. The implications for the financial landscape include the further integration of Bitcoin into traditional investment strategies and the potential for significant price appreciation based on its perceived scarcity and stability. The price may not reach the heights of mainstream adoption but could remain relatively stable and potentially increase to over $50,000 per coin.

This scenario parallels the historical role of gold in times of economic uncertainty.

Scenario 3: Bitcoin Stagnation

This scenario assumes Bitcoin’s growth plateaus, experiencing limited adoption and a muted price trajectory. Factors like persistent regulatory uncertainty, ongoing security concerns, and the emergence of compelling alternative cryptocurrencies could hinder widespread acceptance. The implications for the financial landscape include limited disruption to traditional systems and a relatively stable but not substantially increasing price. The price may remain in the range of $20,000 to $30,000.

This scenario reflects the current situation of many other digital assets that have not achieved widespread adoption.

Scenario 4: Bitcoin Disruption

This scenario posits a radical shift in the cryptocurrency landscape, driven by unforeseen technological breakthroughs or major societal changes. For example, the integration of Bitcoin into emerging technologies like the metaverse or the adoption of new consensus mechanisms could lead to substantial price fluctuations. The implications for the financial landscape could be transformative, potentially reshaping the nature of finance and commerce.

The price could potentially experience large swings, reaching extreme highs or lows depending on the specific developments.

2040 Bitcoin Price Forecast Table

| Scenario |

Low Estimate ($) |

Mid-Range Estimate ($) |

High Estimate ($) |

| Mainstream Adoption |

100,000 |

150,000 |

200,000 |

| Store of Value |

50,000 |

75,000 |

100,000 |

| Stagnation |

20,000 |

25,000 |

30,000 |

| Disruption |

5,000 |

50,000 |

200,000 |

Influence of Emerging Technologies and Societal Trends

The influence of emerging technologies, like artificial intelligence, blockchain advancements, and decentralized autonomous organizations (DAOs), on Bitcoin’s price in 2040 is significant. Societal trends, such as increasing digital literacy, evolving trust in digital assets, and shifts in global economic power dynamics, will also play a crucial role in shaping the future of Bitcoin. These factors could accelerate or decelerate the adoption of Bitcoin, significantly influencing the price forecasts.

Conclusive Thoughts

In conclusion, predicting Bitcoin’s price in 2040 is a complex undertaking. Numerous factors could influence the outcome, from technological breakthroughs to global economic events. While this analysis provides a comprehensive overview of the potential factors at play, it’s crucial to remember that any prediction is inherently uncertain. The future of Bitcoin is likely to be shaped by unpredictable developments, underscoring the inherent risk and reward of this investment.

FAQ Summary

What are the key factors influencing Bitcoin’s price?

Market sentiment, technological advancements, regulatory changes, and global economic events all play significant roles in shaping Bitcoin’s price.

How accurate are past Bitcoin price predictions?

Past predictions have varied in accuracy, often reflecting the inherent volatility of the market and the limitations of forecasting future events.

What are some potential economic shocks that could impact Bitcoin’s price?

Global economic crises, geopolitical tensions, and unexpected policy shifts are potential factors that could disrupt the cryptocurrency market and influence Bitcoin’s price.

How might social media influence Bitcoin’s price?

Social media sentiment and public opinion can influence investor behavior and, consequently, Bitcoin’s price.