Purchasing Bitcoin using various methods, including gift cards, has become increasingly popular. This exploration delves into the intricacies of utilizing Apple gift cards for Bitcoin acquisitions, examining the process, associated risks, and available platforms. Understanding the nuances of this transaction is key for informed decision-making.

A crucial aspect to consider is the security of platforms accepting gift card payments for Bitcoin. Reputable platforms prioritize secure transactions, but potential risks remain. This discussion emphasizes the need for due diligence when selecting a Bitcoin exchange.

Bitcoin Purchase Methods

Acquiring Bitcoin involves various methods, each with its own set of advantages and disadvantages. Understanding these options is crucial for making informed decisions about where and how to buy Bitcoin. Choosing the right method depends on factors like security concerns, transaction speed, and cost.A variety of platforms and services facilitate Bitcoin purchases, from traditional brokerage accounts to specialized exchanges.

This overview examines common methods, highlighting the steps involved, security considerations, and transaction fees. Understanding these details allows users to make more informed decisions regarding their Bitcoin acquisition strategies.

Common Bitcoin Purchase Methods

Several methods are available for acquiring Bitcoin. These include using established cryptocurrency exchanges, brokerage platforms, peer-to-peer (P2P) marketplaces, and even purchasing with gift cards. Each method has unique attributes regarding security and transaction processes.

- Cryptocurrency Exchanges: These platforms are designed specifically for buying and selling cryptocurrencies. Users typically create an account, fund it with fiat currency (like USD), and then use the funds to purchase Bitcoin. Steps typically include account registration, verification, depositing funds, and placing a buy order. Exchanges generally offer a wide range of cryptocurrencies and competitive trading fees.

However, security relies on the exchange’s robust security measures. Pros: Wide selection of cryptocurrencies, competitive fees, user-friendly interfaces. Cons: Potential security risks if the exchange is compromised, regulatory issues in certain jurisdictions.

- Brokerage Platforms: Traditional brokerage platforms are increasingly offering Bitcoin trading. These platforms allow users to buy and sell Bitcoin through their existing brokerage account. The process is similar to buying stocks, with users often following standard brokerage procedures for account funding and order placement. Pros: Integration with existing financial infrastructure, familiar user experience. Cons: Potentially higher fees compared to dedicated cryptocurrency exchanges, limited features for advanced cryptocurrency users.

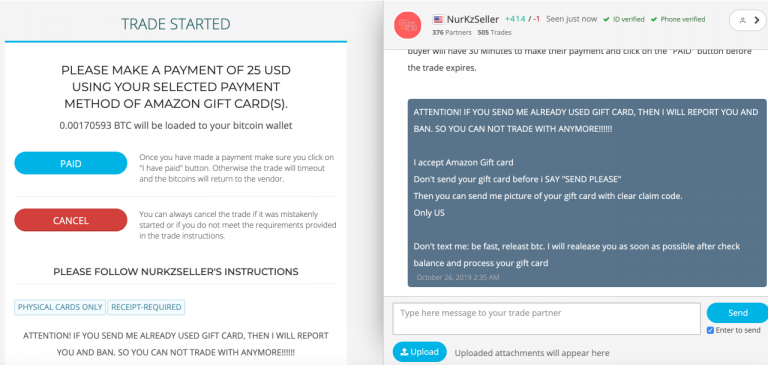

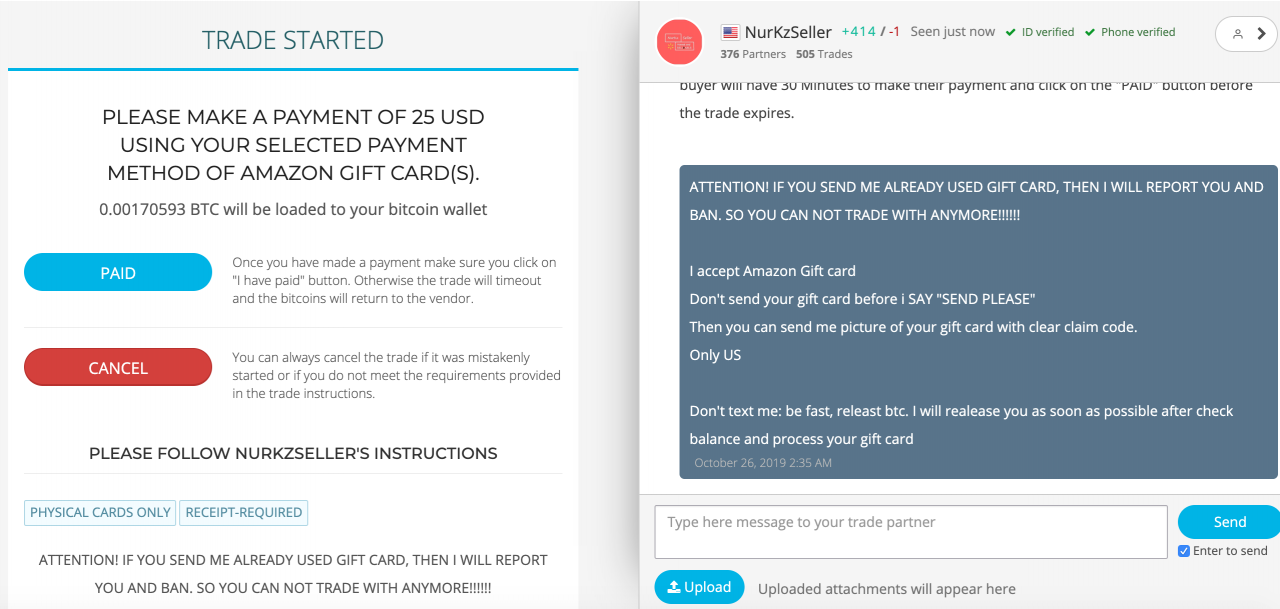

- Peer-to-Peer (P2P) Marketplaces: These platforms connect buyers and sellers directly, enabling transactions without intermediaries. Users can typically negotiate prices and payment terms. Steps include creating an account, setting up a payment method, finding a seller, and finalizing the transaction. Pros: Potentially lower fees compared to exchanges, direct interaction with sellers. Cons: Higher risk of scams and fraudulent activities, buyer/seller due diligence is critical.

- Gift Card Purchases: Some exchanges or marketplaces may allow Bitcoin purchases using gift cards. The process involves obtaining a gift card, linking it to the platform, and using it as payment for Bitcoin. This can be a convenient option, but security measures and associated fees should be carefully evaluated. Pros: Convenience in some cases, potentially lower fees compared to bank transfers.

Cons: Risk of gift card fraud, less regulated than traditional payment methods.

Comparison of Purchase Methods

| Purchase Method | Transaction Speed | Costs (Typical Fees) | Security Level |

|---|---|---|---|

| Cryptocurrency Exchanges | Generally fast (within minutes) | Variable, often low per transaction | High, if the exchange employs strong security measures |

| Brokerage Platforms | Can vary depending on the platform | Potentially higher than exchanges | Medium to high, depending on the platform’s security protocols |

| P2P Marketplaces | Can vary significantly based on the seller and transaction specifics | Potentially low to moderate, often negotiable | Low to medium, high risk of fraud |

| Gift Card Purchases | Can vary based on the platform’s processing times | Variable, potential hidden fees | Low to medium, depending on the gift card provider and platform security |

Transaction Time Comparison

| Payment Method | Typical Transaction Time (Buying Bitcoin) |

|---|---|

| Bank Transfer | 1-3 business days |

| Debit/Credit Card | Immediate to few hours |

| Cryptocurrency Exchange Internal Transfers | Instant |

| Gift Card (via Exchange) | Variable, can take several hours to a few days |

Gift Card Transactions for Bitcoin

Using gift cards to purchase Bitcoin presents a convenient method for acquiring the cryptocurrency. However, it’s crucial to understand the intricacies involved, including the process, limitations, and security considerations. Gift cards offer a certain degree of anonymity, but this convenience comes with potential risks. It’s vital to be aware of these risks and to take appropriate precautions.Gift cards provide a relatively simple way to fund Bitcoin purchases, although the process isn’t as straightforward as using bank transfers.

The key is to identify a reputable Bitcoin exchange that accepts gift cards. This involves careful selection and due diligence to ensure the platform is legitimate. Ultimately, responsible use and awareness of the limitations of gift card transactions are paramount for a smooth and secure experience.

Process of Buying Bitcoin with Gift Cards

The process typically involves selecting a Bitcoin exchange platform that accepts gift cards. After registering and verifying your account, you can add the gift card details during the purchase process. The platform will deduct the value of the gift card from the total Bitcoin purchase amount. The exchange will then process the transaction and credit your Bitcoin wallet.

Understanding the exchange’s specific procedures is essential for a successful transaction.

Limitations and Risks of Using Gift Cards for Cryptocurrency Purchases

Gift cards, while convenient, often come with limitations that can impact Bitcoin purchases. One major concern is the potential for gift card fraud or expiration. Furthermore, the value of the gift card might not align perfectly with the Bitcoin purchase amount, requiring adjustments. In some instances, exchanges may impose restrictions on the amount of Bitcoin that can be purchased using a single gift card.

Security Considerations for Bitcoin Purchases Using Gift Cards

Security is paramount when using gift cards for Bitcoin transactions. Ensure the chosen Bitcoin exchange platform utilizes robust security measures to protect your gift card details and your Bitcoin holdings. Be wary of exchanges with poor security reputations or those that don’t offer clear details on their security protocols. Always review the platform’s privacy policy to understand how your data is handled.

List of Gift Card Types Usable for Bitcoin Purchases (with Limitations)

- Prepaid Cards: Prepaid cards, like Visa or Mastercard gift cards, are often accepted by exchanges. However, restrictions might apply depending on the exchange and the issuing company. Some cards might have usage limitations or regional restrictions.

- E-Gift Cards: E-gift cards, which are digital, present a similar process to prepaid cards. However, verification and transaction processes may vary slightly depending on the platform and the gift card issuer.

- Retail Gift Cards: Some retail gift cards can be used for Bitcoin purchases, but acceptance is not universal. Always check the specific terms and conditions of the gift card and the Bitcoin exchange to avoid issues.

Verification of Legitimate Bitcoin Exchange Platforms

Verifying a platform’s legitimacy is crucial to ensure the safety of your gift card and Bitcoin. Look for exchanges with strong security measures, verified identity, and positive user reviews. Review the exchange’s website for contact information, licensing details, and any information about their security practices. Check with independent review sites or consumer protection agencies to ascertain the platform’s reputation.

Consider the exchange’s history, user reviews, and customer support responsiveness to make an informed decision.

Legality and Regulation of Bitcoin Purchases

Buying Bitcoin with gift cards, while seemingly straightforward, can involve complex legal and regulatory considerations. Jurisdictions vary significantly in their approach to cryptocurrency transactions, and understanding these nuances is crucial for both buyers and sellers. This section examines the legal aspects of gift card-based Bitcoin purchases, highlighting potential risks and regulatory frameworks.Gift card usage for cryptocurrency purchases is not uniformly regulated across countries.

Different jurisdictions have distinct legal frameworks governing gift cards, digital assets, and the interaction between the two. This often leads to varying degrees of legal clarity and enforcement, impacting the overall risk profile of such transactions.

Legal Aspects of Gift Card-Based Bitcoin Transactions

The legal landscape surrounding gift card use for cryptocurrency purchases is often unclear, particularly concerning the legality of using gift cards to acquire cryptocurrencies that are not explicitly supported by the gift card issuer. Many jurisdictions are still developing clear regulatory frameworks for cryptocurrencies and related activities.

Potential Legal Risks

Using gift cards to purchase Bitcoin may expose individuals to legal risks, especially if the transaction violates gift card terms of service or relevant consumer protection laws. Misuse of gift cards or engaging in fraudulent activities could result in legal repercussions, including fines or criminal charges.

Relevant Regulations and Guidelines

Numerous regulations and guidelines govern gift card usage and cryptocurrency transactions in different countries. These vary greatly and may include restrictions on gift card resale, limitations on gift card use for specific transactions, and potential restrictions on the usage of gift cards for purchases of cryptocurrencies. Understanding these regulations is critical to avoid legal complications.

Comparison of Regulations Across Countries

The regulations regarding the use of gift cards for Bitcoin purchases differ substantially across countries. For example, some countries may have specific laws regarding the resale of gift cards, while others might focus on the cryptocurrency aspect. A comparison of regulations requires a detailed examination of individual jurisdictions and their corresponding legal frameworks.

| Country | Gift Card Regulations | Cryptocurrency Regulations | Potential Legal Risks |

|---|---|---|---|

| United States | Vary by state, often focused on consumer protection. | Emerging regulatory landscape, with ongoing debate. | Potential violation of gift card terms, consumer protection laws, and potential fraud. |

| European Union | Vary by member state, with emphasis on consumer protection and data privacy. | Developing regulatory framework, with emphasis on financial markets. | Potential violation of consumer protection laws, money laundering regulations, and market abuse. |

| Japan | Regulations focused on consumer protection and financial transactions. | Relatively progressive approach to cryptocurrency regulation. | Potential violation of financial regulations, and money laundering laws. |

Tax Implications

The tax implications of purchasing Bitcoin with gift cards depend on the specific jurisdiction and the individual’s tax situation. In many countries, cryptocurrency transactions are treated as capital gains or losses, subject to taxation rules that are frequently updated.

“Capital gains or losses on Bitcoin transactions are typically taxed as ordinary income, unless otherwise specified by local tax regulations.”

Bitcoin Purchase Platforms

Finding reputable platforms for buying Bitcoin with gift cards is crucial for a smooth and secure transaction. Users need to be cautious and informed to avoid potential scams or fraudulent activities. Thorough research and understanding of platform policies and security measures are essential.

Reputable Bitcoin Purchase Platforms

Many platforms facilitate Bitcoin purchases using various payment methods, including gift cards. However, not all platforms are created equal, and due diligence is necessary. Choosing a platform with a proven track record and transparent policies is critical.

Platforms Accepting Gift Card Purchases

| Platform Name | Supported Gift Card Types | Fees |

|---|---|---|

| Coinbase | Various gift cards (e.g., Visa, Mastercard, Amazon) | Transaction fees vary based on the amount and type of payment method. |

| Kraken | Various gift cards (e.g., Visa, Mastercard, Amazon) | Transaction fees vary based on the amount and type of payment method. |

| Gemini | Various gift cards (e.g., Visa, Mastercard, Amazon) | Transaction fees vary based on the amount and type of payment method. |

| Bitstamp | Limited support for gift cards (e.g., Visa, Mastercard) | Transaction fees vary based on the amount and type of payment method. |

Note: Fees and supported gift card types may vary, and it’s essential to check the platform’s current policies directly for the most up-to-date information.

Factors to Consider When Choosing a Platform

Choosing the right platform is critical to a successful Bitcoin purchase. Several factors need careful consideration, including security measures, customer reviews, and the platform’s reputation. Furthermore, the platform’s transaction fees and supported gift card types play a significant role.

Importance of Customer Reviews and Security Measures

Thoroughly researching customer reviews is crucial when evaluating a platform. Negative reviews regarding security breaches or poor customer service can be a warning sign. Robust security measures, such as two-factor authentication and encryption protocols, are essential for safeguarding user funds and information. A platform’s security measures should be evaluated for compliance with industry standards and best practices.

Comparing Bitcoin Platforms’ Security Protocols

Different platforms employ various security protocols to protect user data and funds. Comparing these protocols helps users make informed decisions. Look for platforms with strong encryption, multi-factor authentication, and robust security audits to ensure the protection of user data. These measures are vital in mitigating risks and safeguarding against potential security threats.

General Bitcoin Purchase Information

Bitcoin, a decentralized digital currency, has gained significant traction in recent years. Its unique characteristics and operating mechanism have attracted both investors and everyday users. Understanding these aspects is crucial for anyone considering purchasing Bitcoin.Understanding the mechanics of Bitcoin and its role in the broader cryptocurrency landscape empowers informed decision-making when exploring potential purchases. This section provides a foundational overview of Bitcoin’s core concepts and functionality, along with its relationship to other cryptocurrencies and the crucial role of exchanges in facilitating transactions.

Bitcoin and its Characteristics

Bitcoin operates independently of central banks and governments. Its characteristics include scarcity, transparency, and security. Bitcoin’s decentralized nature ensures that no single entity controls its issuance or operation. This decentralized structure, coupled with cryptographic security measures, contributes to its robustness and appeal. The limited supply of Bitcoin, approximately 21 million coins, also influences its value and investment potential.

How Bitcoin Works

Bitcoin transactions are recorded on a public ledger called the blockchain. This distributed database ensures transparency and immutability. Each transaction is cryptographically verified and linked to previous transactions, forming a chain of blocks. The process involves cryptographic hashing, digital signatures, and consensus mechanisms to secure and validate transactions.

Cryptocurrency Exchanges and Bitcoin Purchases

Cryptocurrency exchanges play a vital role in facilitating Bitcoin purchases. These platforms provide a marketplace where buyers and sellers can interact, enabling seamless transactions. Exchanges typically offer various trading pairs, including Bitcoin against fiat currencies like the US dollar. They provide a structured environment for Bitcoin trading and ensure a degree of security and reliability in the exchange process.

Bitcoin vs. Other Cryptocurrencies

While Bitcoin is the pioneering cryptocurrency, many other cryptocurrencies exist. These alternative cryptocurrencies often differ in their functionalities, underlying technologies, and use cases. Factors like transaction speed, scalability, and utility applications distinguish Bitcoin from other cryptocurrencies. Understanding these differences is crucial for selecting the appropriate cryptocurrency for investment or use.

Key Bitcoin Terminology

| Term | Definition |

|---|---|

| Wallet | A digital storage system for holding and managing Bitcoin and other cryptocurrencies. |

| Transaction | The process of transferring Bitcoin from one wallet to another. |

| Blockchain | A decentralized, public ledger that records all Bitcoin transactions in a secure and transparent manner. |

| Mining | The process of verifying and adding new transactions to the blockchain. Miners are rewarded with newly created Bitcoin for their efforts. |

| Bitcoin Address | A unique alphanumeric string that identifies a specific Bitcoin wallet. |

General Information about Buying Bitcoin

Bitcoin, a decentralized digital currency, can be purchased through various methods. Understanding these methods and the underlying process is crucial for navigating the world of cryptocurrencies safely and effectively. This section provides a comprehensive overview of buying Bitcoin, including the factors influencing its price and examples of popular platforms.

Methods for Purchasing Bitcoin

Different methods cater to various needs and preferences. Direct exchange with other users, often facilitated through peer-to-peer platforms, offers a potentially lower transaction fee, but comes with greater risk of fraud. Traditional financial methods, such as bank transfers, allow more regulated and secure transactions but may involve higher fees and longer processing times.

Bitcoin can be purchased using a variety of methods, each with its own advantages and disadvantages. Choosing the right method depends on factors like security, transaction speed, and fees.

- Peer-to-Peer (P2P) Exchanges: These platforms connect buyers and sellers directly, enabling transactions outside the traditional financial system. This method may offer lower fees compared to exchanges, but carries a higher risk of scams and requires careful scrutiny of seller reputation and transaction history.

- Cryptocurrency Exchanges: Exchanges like Coinbase, Kraken, and Binance offer a centralized platform for buying and selling Bitcoin. They provide a more regulated environment with enhanced security measures. These platforms often require verification and may impose fees on transactions.

- Over-the-Counter (OTC) Markets: These markets facilitate transactions between individuals or institutions on a more customized basis. Suitable for large transactions, OTC markets offer greater flexibility and tailored services but often come with higher fees and require careful due diligence.

- Using Gift Cards: Some platforms allow the purchase of Bitcoin using gift cards. These methods may not be as widely available or accessible as traditional methods. This often involves a conversion step and may incur extra fees.

Bitcoin Purchase Process Overview

The process of buying Bitcoin typically involves several steps. First, users need to select a reputable platform or method. Next, they need to create an account, complete KYC (Know Your Customer) procedures, and fund their account with the desired payment method. Finally, they can place an order to buy Bitcoin.

The process of buying Bitcoin typically involves account creation, funding, and placing an order. Security and due diligence are crucial aspects of this process.

- Account Creation and Verification: Registering with a platform usually involves providing personal information and undergoing verification to meet regulatory requirements.

- Funding the Account: Users fund their accounts with the preferred payment method, such as bank transfers or credit/debit cards.

- Placing the Bitcoin Order: After sufficient funds are available, users can place an order to buy Bitcoin at a specified price.

- Transaction Confirmation: Once the order is confirmed, the transaction is processed, and the Bitcoin is credited to the user’s account.

Factors Influencing Bitcoin Price

Several factors influence the fluctuating price of Bitcoin. Market sentiment, regulatory changes, and technological advancements are key drivers. The supply and demand dynamics also play a pivotal role in determining the price.

Bitcoin’s price is influenced by various factors, including market sentiment, regulatory changes, and technological advancements.

- Market Sentiment: Investor confidence and general market sentiment can significantly impact the price. Positive news or trends tend to drive prices upward, while negative news or concerns can lead to price drops.

- Regulatory Changes: Governments’ policies and regulations concerning cryptocurrencies can influence investor confidence and market activity, potentially affecting the price.

- Technological Advancements: New developments and innovations in blockchain technology and related applications can influence investor interest and consequently affect the price.

- Supply and Demand: The balance between supply and demand for Bitcoin plays a critical role in price determination. Increased demand relative to supply can drive prices higher, while decreased demand can lead to price declines.

Examples of Bitcoin Purchase Platforms

Numerous platforms facilitate Bitcoin purchases. Popular choices include Coinbase, Kraken, and Binance. These platforms offer various features and services, and the best platform choice depends on individual needs and preferences.

Coinbase, Kraken, and Binance are examples of popular Bitcoin purchase platforms. These platforms cater to diverse needs, offering varying services and features.

| Platform | Features | Pros | Cons |

|---|---|---|---|

| Coinbase | User-friendly interface, strong security | Easy to use, secure platform | Limited trading options, higher fees for some transactions |

| Kraken | Advanced trading tools, wide range of cryptocurrencies | Advanced features, wide selection | Steeper learning curve, potentially higher fees |

| Binance | Large trading volume, extensive features | High liquidity, many trading options | More complex interface, potentially higher fees |

Last Point

In conclusion, while purchasing Bitcoin with gift cards like Apple gift cards is feasible, it’s essential to thoroughly research the process, associated risks, and regulations. Choosing reputable platforms, understanding security protocols, and considering the potential legal implications are critical steps for a safe and successful transaction. This comprehensive overview provides the necessary knowledge to navigate this evolving digital landscape.

General Inquiries

Can I use any gift card to buy Bitcoin?

No, not all gift cards are accepted for Bitcoin purchases. The specific types accepted vary by platform. Check the platform’s terms and conditions.

What are the typical fees associated with using gift cards for Bitcoin purchases?

Fees can vary based on the platform and the specific gift card. Some platforms may charge transaction fees or percentage-based fees. Review the platform’s fee schedule.

Are there legal restrictions on using gift cards to buy Bitcoin in my country?

Regulations vary by jurisdiction. Research the legal implications in your region before proceeding.

What are the security measures I should look for when choosing a platform?

Look for platforms with robust security measures like two-factor authentication and secure payment gateways. Check for customer reviews and regulatory compliance.